After completing my first full year as CEO, I am excited about our Company’s achievements and the progress we have made in strengthening our leadership in the medical technology industry. As you read through this review, I believe you will agree that Stryker is well positioned for the future.

In 2013, we met our primary objectives — achieved strong top-line growth, delivered solid operational earnings, expanded globally, and invested through R&D and acquisitions to strengthen our product and service offerings.

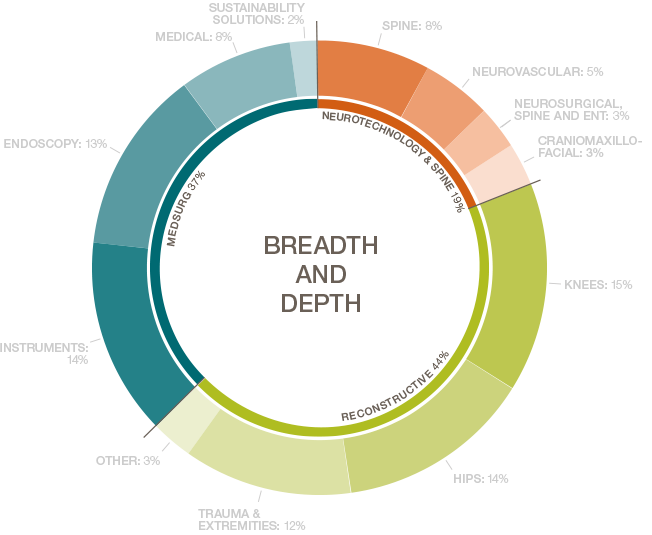

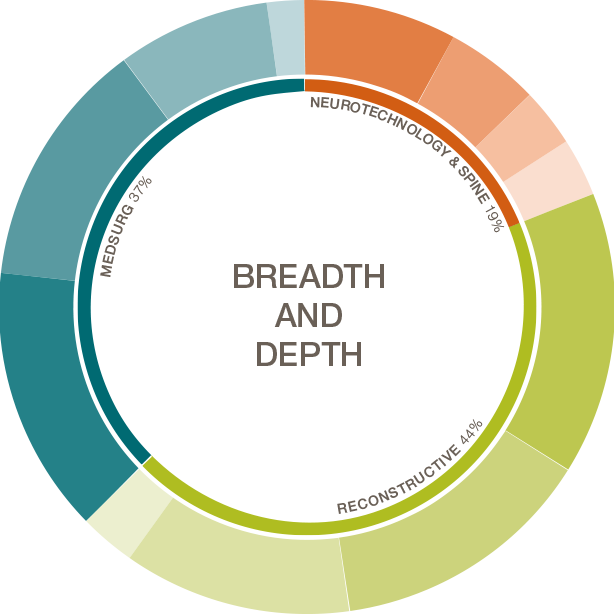

This segment includes knees, hips, trauma & extremities, including foot & ankle, and other products such as sports medicine (joint preservation) and orthobiologics & biosurgery.

This segment includes instruments (bone cutting & surgical accessories and computer-assisted surgery), endoscopy (minimally invasive surgical solutions and integration & connectivity), medical (patient care, patient handling and emergency medical services equipment), and sustainability solutions (reprocessing and remanufacturing).

This segment includes spinal implants and interventional spine products, neurovascular, NSE (neurosurgical, spine and ear, nose and throat) and craniomaxillofacial products.

In 2013, our organic growth (excluding acquisitions and foreign exchange) of 5% was at the high end of medical technology, including double-digit growth in many businesses, a successful turnaround in Europe, and rapid growth in emerging markets.

Trauma & Extremities, Neurotechnology, Endoscopy, and our Hip business all had strong above-market growth in the year. In Europe, which remains a challenging market, our turnaround occurred ahead of schedule as we returned to market growth by the middle of the year. We will also be establishing a European headquarters in Amsterdam in 2014 to strengthen our foundation for future growth.

We had very strong double-digit gains in Emerging Markets, led by China, with excellent results in both the premium and value segments of the market. Emerging markets grew from 6% of total Company sales in 2012 to over 7% of sales in 2013, and we expect this trend to continue, given the significant opportunity in these markets.

We completed two strategic acquisitions, Trauson Holdings Company Limited and MAKO Surgical Corp., which provide exciting growth prospects for years to come. Trauson, our first acquisition in China, which was completed in March, enables us to compete in the lower-priced segment of the growing orthopaedic market in China and other markets. The integration has proceeded smoothly and we are delighted to be on track with our expectations.

In late December 2013, we closed the acquisition of MAKO, which provides us with a robotic arm assisted platform for reconstructive surgery. It holds the promise to deliver consistent, reproducible procedures that will enhance the surgeon and patient experience. We view this as a unique opportunity to transform orthopaedic surgery over time, including new implant designs enabled by robotics.

Also in December 2013, we announced our intent to acquire Patient Safety Technologies, Inc., whose proprietary software helps prevent retained foreign objects in patients while in the operating room, thereby improving patient safety and reducing healthcare costs. This acquisition will fold into the Instruments division and will complement existing technologies and solutions that improve caregiver and patient safety.

Additionally, we continued to strengthen our quality program, with successful results from regulatory inspections, and we received 510(k) FDA clearance to market a modified Neptune 2 Waste Management System, which is an important product to our customers as it reduces harmful exposure to fluids and smoke in the operating room.

| HISTORY OF REVENUE GROWTH | ||

| $ IN BILLIONS | ||

| 10.0 |

1993

2013

|

|

| 8.0 | ||

| 6.0 | ||

| 4.0 | ||

| 2.0 | ||

| 0.0 | ||

| adjusted diluted net earnings1,2 | ||

| $ per share | ||

| 5.0 |

2008

2013

|

|

| 4.0 | ||

| 3.0 | ||

| 2.0 | ||

| 1.0 | ||

| 0.0 | ||

| DIVIDENDS PAID | ||

| $ PER SHARE OF COMMON STOCK | ||

| 1.5 |

2008

2013

|

|

| 1.0 | ||

| 0.5 | ||

| 0.0 | ||

| CASH FLOW PROVIDED BY OPERATING ACTIVITIES | ||

| $ IN BILLIONS | ||

| 2.5 |

2008

2013

|

|

| 2.0 | ||

| 1.5 | ||

| 1.0 | ||

| 0.5 | ||

| 0.0 | ||

| (IN MILLIONS, EXCEPT PER SHARE AMOUNTS) | 2013 | 2012 | % Change |

|---|---|---|---|

| NET SALES | $ 9,021 | $ 8,657 | 4.2 |

| EARNINGS BEFORE INCOME TAXES | 1,212 | 1,705 | (28.9) |

| INCOME TAXES | 206 | 407 | (49.4) |

| NET EARNINGS | 1,006 | 1,298 | (22.5) |

| ADJUSTED NET EARNINGS2,3 | 1,616 | 1,560 | 3.6 |

| DILUTED NET EARNINGS PER SHARE OF COMMON STOCK: | |||

| REPORTED | $ 2.63 | $ 3.39 | (22.4) |

| ADJUSTED1,2 | 4.23 | 4.07 | 3.9 |

| DIVIDENDS PAID PER SHARE OF COMMON STOCK | $ 1.06 | $ 0.85 | 24.7 |

| CASH, CASH EQUIVALENTS AND CURRENT MARKETABLE SECURITIES | 3,980 | 4,285 | (7.1) |

1A non-GAAP financial measure. The most comparable GAAP financial measure is diluted net earnings per share, which were $2.78, $2.77, $3.19, $3.45, $3.39 and $2.63 in 2008, 2009, 2010, 2011, 2012 and 2013, respectively.

2For a reconciliation between these non-GAAP financial measures and their most comparable GAAP financial measure, refer to our Annual Reports on Form 10-K, available on our website at www.stryker.com or at the SEC’s website at www.sec.gov.

3A non-GAAP financial measure. The most comparable GAAP financial measure is net earnings.

We delivered consistent results throughout 2013, with net sales reaching $9 billion, a 4.2% increase, and our adjusted diluted net EPS was $4.23 per share, a 3.9% increase. Both net sales and adjusted diluted net EPS were impacted by foreign exchange; earnings were also negatively affected by the U.S. Medical Device Excise Tax. Adjusting for these items, adjusted diluted net EPS improved by double digits, showing strong operational leverage.

We also continued to generate healthy operational cash flow, up 14% vs. 2012, which contributed to cash equivalents and marketable securities exceeding debt by $1.2 billion at the end of the year. This balance sheet strength enabled us to complete acquisitions, announce an increase in our dividend per share of 15% for the January 2014 payment, and repurchase $317 million of shares during the year.

from left to right

Former Chairman, President and Chief Executive Officer, Harris Corporation;

Director, Eastman Chemical Company

Former President, Raytheon Missile Systems;

Former Vice President, Raytheon Company; Chair, Tucson Medical Center Healthcare Board of Trustees;

Director, UNS Energy Corporation

Chairman and Chief Executive Officer, IDEX Corporation; Trustee, Manufacturers Alliance for Productivity and Innovation

Non-Executive Chairman, Stryker Corporation;

Chairman and Chief Executive Officer, MPI Research, Inc.;

Director, Monsanto Company;

Director, Taubman Centers, Inc.

President and Chief Executive Officer, Stryker Corporation;

Director, Parker-Hannifin Corporation

Partner, Greylock;

Director, Secretary of Defense Business Board;

Member, Harvard Medical School Board of Fellows;

Member, Investment Committees of the Dana Farber Cancer Institute, Partners Healthcare System, Inc. and the Boston Museum of Fine Arts

President, United States Program for the Bill & Melinda Gates Foundation

Vice Chair and Director, Greenleaf Trust;

Trustee, Spelman College and Kalamazoo College;

Vice Chair, Kalamazoo Community Foundation;

granddaughter of the founder of the Company and daughter of a former president of the Company

Chief Executive Officer and Chairman of the Executive Committee, UCB S.A.

Arthur Lowes Dickinson Professor of Accounting, Harvard University;

Director, Novartis AG;

Director, ICF International, Inc.;

Director, T-Mobile US, Inc.;

Director, HCL Technologies, Ltd.

* Audit Committee

** Finance Committee

† Compensation Committee

‡ Governance and Nominating Committee

President and Chief Executive Officer

Vice President, Communications,

Public Affairs and Strategic Marketing

Vice President, Human Resources

Vice President, Chief Medical and

Scientific Officer

Group President, Global Quality and

Operations

Group President, Orthopaedics

Vice President and Chief Legal Officer

Vice President and Chief Financial Officer

Vice President, Strategy and Investor

Relations

Group President, MedSurg and

Neurotechnology

Group President, International

Chairman Emeritus and former

Chairman, President and Chief

Executive Officer of Stryker Corporation

Vice President, Corporate Secretary

Vice President, Corporate Controller

Vice President, Finance and Treasurer

Vice President, Tax

Vice President, Finance Training,

Development and Internal Audit

Vice President, Regulatory Affairs

and Quality Assurance

Vice President, Compliance and

Risk Management

President, Europe

President, Japan

President, Performance Solutions

President, Instruments

President, Reconstructive

President, Eastern Europe, Middle East,

Africa & India

President, Trauma & Extremities

President, South Pacific

President, Americas

President, Neurovascular

President, Endoscopy

President, Medical

President, Greater China & Trauson International

President, Spine

President, Sustainability Solutions

The Board of Directors and Management of Stryker Corporation acknowledge the retirement of William R. Enquist, President, Endoscopy division, after 27 years of dedicated service. Mr. Enquist led the San Jose, California–based Endoscopy division for 17 years. During his tenure as division president, annual global sales of our endoscopy products grew from $90 million to over $1 billion. Under his leadership, the division was consistently recognized for industry-leading product innovation, outstanding sales execution, strong employee engagement, and success in developing and exporting leaders to other divisions within Stryker. In recent years, the Endoscopy division has been consistently recognized as a top place to work in the Bay Area by several publications, including the San Francisco Business Times, the Silicon Valley Business Journal, and the San Jose Mercury News. Mr. Enquist’s success in driving a highly engaged culture and building winning leadership teams leaves the Endoscopy division well poised for continued success.

Former Chairman, President and Chief Executive Officer, Harris Corporation;

Director, Eastman Chemical Company

Former President, Raytheon Missile Systems; Former Vice President, Raytheon Company; Chair, Tucson Medical Center Healthcare Board of Trustees; Director, UNS Energy Corporation

Chairman and Chief Executive Officer, IDEX Corporation; Trustee, Manufacturers Alliance for Productivity and Innovation

Non-Executive Chairman, Stryker Corporation; Chairman and Chief Executive Officer, MPI Research, Inc.; Director, Monsanto Company; Director, Taubman Centers, Inc.

President and Chief Executive Officer, Stryker Corporation; Director, Parker-Hannifin Corporation

Partner, Greylock; Director, Secretary of Defense Business Board; Member, Harvard Medical School Board of Fellows; Member, Investment Committees of the Dana Farber Cancer Institute, Partners Healthcare System, Inc. and the Boston Museum of Fine Arts

President, United States Program for the Bill & Melinda Gates Foundation

Vice Chair and Director, Greenleaf Trust; Trustee, Spelman College and Kalamazoo College; Vice Chair, Kalamazoo Community Foundation; granddaughter of the founder of the Company and daughter of a former president of the Company

Chief Executive Officer and Chairman of the Executive Committee, UCB S.A.

Arthur Lowes Dickinson Professor of Accounting, Harvard University; Director, Novartis AG; Director, ICF International, Inc.; Director, T-Mobile US, Inc.; Director, HCL Technologies, Ltd.

* Audit Committee

** Finance Committee

† Compensation Committee

‡ Governance and Nominating Committee

President and Chief Executive Officer

Vice President, Communications,

Public Affairs and Strategic Marketing

Vice President, Human Resources

Vice President, Chief Medical and

Scientific Officer

Group President, Global Quality and

Operations

Group President, Orthopaedics

Vice President and Chief Legal Officer

Vice President and Chief Financial Officer

Vice President, Strategy and Investor

Relations

Group President, MedSurg and

Neurotechnology

Group President, International

Chairman Emeritus and former

Chairman, President and Chief

Executive Officer of Stryker Corporation

Vice President, Corporate Secretary

Vice President, Corporate Controller

Vice President, Finance and Treasurer

Vice President, Tax

Vice President, Finance Training,

Development and Internal Audit

Vice President, Regulatory Affairs

and Quality Assurance

Vice President, Compliance and

Risk Management

President, Europe

President, Japan

President, Performance Solutions

President, Instruments

President, Reconstructive

President, Eastern Europe, Middle East,

Africa & India

President, Trauma & Extremities

President, South Pacific

President, Americas

President, Neurovascular

President, Endoscopy

President, Medical

President, Greater China & Trauson International

President, Spine

President, Sustainability Solutions

The Board of Directors and Management of Stryker Corporation acknowledge the retirement of William R. Enquist, President, Endoscopy division, after 27 years of dedicated service. Mr. Enquist led the San Jose, California–based Endoscopy division for 17 years. During his tenure as division president, annual global sales of our endoscopy products grew from $90 million to over $1 billion. Under his leadership, the division was consistently recognized for industry-leading product innovation, outstanding sales execution, strong employee engagement, and success in developing and exporting leaders to other divisions within Stryker. In recent years, the Endoscopy division has been consistently recognized as a top place to work in the Bay Area by several publications, including the San Francisco Business Times, the Silicon Valley Business Journal, and the San Jose Mercury News. Mr. Enquist’s success in driving a highly engaged culture and building winning leadership teams leaves the Endoscopy division well poised for continued success.

One key reason for our success is the decentralized manner in which we operate our businesses. Division presidents have direct responsibility for Sales, Marketing, R&D and Business Development. They are laser-focused on their customers’ needs, and their teams’ entrepreneurial spirit drives sustained, high growth. Specialized sales forces, with drive and passion, continue to be a core strength at Stryker.

We also have a high-performing Global Quality and Operations organization that is on track with our program to save $500 million in cumulative costs through network and supply chain improvements. This includes a newly created distribution center in Indianapolis, Indiana, and efficiencies through our Venlo, Netherlands, distribution center. Our goal is to continue to deliver year-over-year favorable reductions in cost of goods sold, working capital improvements of $250 million, and a 30-day improvement in days of inventory on hand. In 2013, despite pricing pressure, our adjusted gross margin expanded by 30 basis points, excluding the impact of the Medical Device Excise Tax.

At Stryker, our business is built on sustainability – making long-term contributions, in a responsible way, to our customers and their patients, to our employees, to our communities and to our shareholders.

Stryker provides reprocessing and remanufacturing services for medical devices, as well as comprehensive recycling and redistribution initiatives. We were the first global original manufacturer to offer these kinds of programs to help meet the resource management demands of our hospital partners. We help redirect consumable and financial resources to promote healthy and responsible hospitals.

Single-use medical device reprocessing programs have become a best practice among 3,000+ hospitals across the U.S., including most of those listed on U.S. News & World Report’s “Honor Roll.” In 2013, Stryker helped hospitals and ambulatory surgery centers save more than $255 million in supply expenses and divert close to 8.9 million pounds of waste from landfills.

Since 1999, Stryker has donated more than $1 million in cash and products to Operation Smile, supported hundreds of medical professionals from around the world through the Physician’s Training Program, and sponsored more than 100 plastic surgery residents in the Stryker Fellowship program.

During the year, we fully staffed the Stryker Executive Leadership Team, a talented group of individuals with deep healthcare experience and a diversity of backgrounds and styles. We established a new mission statement for the Company: Together with our customers, we are driven to make healthcare better. This mission is being rolled out across the Company and recognizes our commitment to close customer connections, our unique performance-driven culture, and our sense of purpose in improving healthcare. We also chose to be explicit about our values: Integrity, Accountability, People, and Performance. These values are hallmarks of Stryker’s culture and will remain in place regardless of how we evolve to meet the changing landscape.

#3 in 2013; Recipient for the twelfth consecutive year

#305 in 2013; Joined the list in 2003 as #493

Stryker UK Ltd. Recipient for the seventh consecutive year

#42 in January 2014; Recipient for the Fourth consecutive year

#42 in 2013; Recipient for the fourth consecutive year

Recipient for the sixth time

These are exciting times for Stryker and our industry, and we plan to deliver another solid financial performance in 2014. We expect organic sales growth to be in the range of 4.5% to 6.0%, once again at the high end of medical technology. If foreign currency exchange rates hold near current levels, we expect a less than 1% negative impact on net sales. Regarding earnings, we will exclude amortization of intangible assets from our adjusted diluted net earnings per share, which we expect to be in the range of $4.75 to $4.90, using this new measure. This represents a 6% to 9% improvement over 2013, which is solid operational leverage, considering that foreign exchange will continue to weigh on earnings, especially in the first half of the year.

As we close out a productive year and look confidently to the future, I want to take a moment to thank our Non-Executive Chairman Bill Parfet and our Board of Directors for their support and guidance regarding our growth agenda. I also want to express my appreciation to Director Howard Lance, who will be retiring from the Board after four years of service, and officially welcome our newest Director, Andy Silvernail, CEO of IDEX Corporation.

I also want to express my gratitude to our more than 25,000 employees around the world, who inspire me every day with their hard work, creativity and initiative. We continue to receive many accolades for employee engagement, including Fortune magazine’s designation, for the fourth consecutive year, that Stryker is one of the 100 Best Companies to Work For in the U.S. As I travel the world and see our progress, it is clear to me that we are well positioned for the future.

Sincerely,

President & Chief Executive Officer