Innovation

We finished 2010 in a stronger position to deliver innovation, both through our internal investments in product development as well as the innovation pipelines we gained through acquisitions made during the year. Many of our core product franchises—hips, knees, trauma, spine, surgical equipment and navigation systems, endoscopic and communications systems, and patient handling and emergency medical equipment—delivered new technologies in 2010. Our technologies and processes produced 108 new U.S. patents in 2010, which indicates the vitality of our research and development streams. As we continue to expand our role in the lives of caregivers and patients and in the operations of healthcare networks, we expect to make larger investments in innovation that will help us continue our exceptional track record of growth as we become an even stronger global leader in the medical technology industry.

Costs

The global economic environment continues to put the healthcare industry under considerable pressure to control costs. In response, we have concentrated on managing our own business more efficiently. In the last year, we’ve taken steps to coordinate key functions within the company, such as quality, procurement, distribution, manufacturing, logistics, financial systems, human resources and information technology—areas where scale, integration and consistency can deliver tremendous operational and financial advantages.

Stronger coordination drives operational efficiencies. At the same time, it frees our individual, entrepreneurial businesses and their leaders to focus their market-specific expertise on product innovation, customer relationships and top-line growth. We expect our increase in internal coordination to not only increase the consistency of our own practices and the effectiveness of our systems, but, as a result, become even more effective at collaborating with customers and delivering products and solutions that make them more efficient.

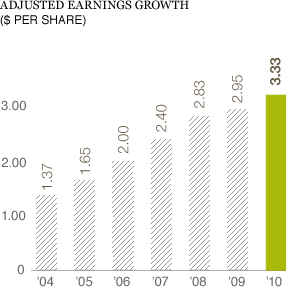

| Year | $ Per Share |

|---|---|

| 2010 | 3.33 |

| 2009 | 2.95 |

| 2008 | 2.83 |

| 2007 | 2.40 |

| 2006 | 2.00 |

| 2005 | 1.65 |

| 2004 | 1.37 |

Adjusted to exclude certain charges and gains, including property, plant and equipment impairment, gain on sale of property, plant and equipment, patent litigation, restructurings, intangible asset impairment, in-process research and development, income taxes on repatriation of foreign earnings, acquisition-related items and discontinued operations.