“The acceptance of change and the opportunity to reinvent ourselves is both a great challenge and a great growth experience for Stryker.”

From December 31, 2009, when we completed our acquisition of Ascent Healthcare Solutions, to January 3, 2011, when we completed the acquisition of the assets of Boston Scientific’s Neurovascular division, Stryker initiated or closed five significant acquisitions. That’s a lot of work in 368 days, but they represent a big opportunity going forward.

We intend to be a significant competitor in every market where we compete. The acquisition of Boston Scientific’s Neurovascular business is a significant part of a long-term strategy to make a bigger impact in the healthcare arena and greatly expand our footprint in a highly innovative, high-growth space—moving us from a solid player to the leader in neurovascular. The acquisition is projected to add over $300 million in annual revenue to our existing $320 million neurotechnology business. But more important, it creates a continuum of capability that extends from skull and facial reconstruction procedures and spinal surgeries to stents, coils and other medical technologies used to treat aneurysms and cerebrovascular disease.

Together, we believe these capabilities give us an offering that addresses more of the human body—and better positions us across this valuable market.

Greater clinical reach and relevance were also behind our Ascent acquisition. Ascent’s strengths in reprocessing and remanufacturing medical devices are enhancing Stryker’s relationships with hospital management and operations. Our remaining 2010 acquisitions, Gaymar Industries, the MEDPOR assets of Porex Surgical, Inc. and the Sonopet Ultrasonic Aspirator, fit our existing expertise and capabilities, but add key strengths. Gaymar, a supplier of high-performance support surfaces for hospital beds, gives us solutions for alleviating bed sores and managing patients’ body temperature; MEDPOR products are implantable porous polyethylene products that are used in reconstructive surgery of the face, eye and head and expand our presence in the craniomaxillofacial (CMF) market; and the Sonopet Ultrasonic Aspirator is used for soft tissue and fine bone dissection in neurosurgery. Together, these acquisitions extend our core offerings into adjacent markets where we have a presence and knowledge base, and give us a broader product offering to patients and clinicians.

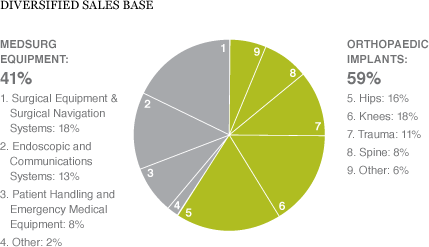

Diversified Sales Base

-

Medsurg Equipment: 41%

- Surgical Equipment & Surgical Navigation Systems: 18%

- Endoscopic and Communications Systems: 13%

- Patient Handling and Emergency Medical Equipment: 8%

- Other: 2%

-

Orthopaedic Implants: 59%

- Hips: 16%

- Knees: 18%

- Trauma: 11%

- Spine: 8%

- Other: 6%